Mobile advertising spend and forecasts

Within the Mobile marketing ecosystem, in-app advertising is by far the fastest growing format, whereby app developers are paid to deliver ad content to users. According to Statista, mobile ad spending amounted to $190 billion in 2019 – and that figure is expected to grow to more than $280 billion by 2022.

Mobile apps offer an engaging and dynamic environment for advertisers to capture consumers’ attention and encourage them to view and interact with their ads. This in-built interaction with the end-user makes in-app advertising such an attractive channel for marketers, with the app’s own characteristics also allowing communication with targeted audiences.

Why is in-app advertising hot right now?

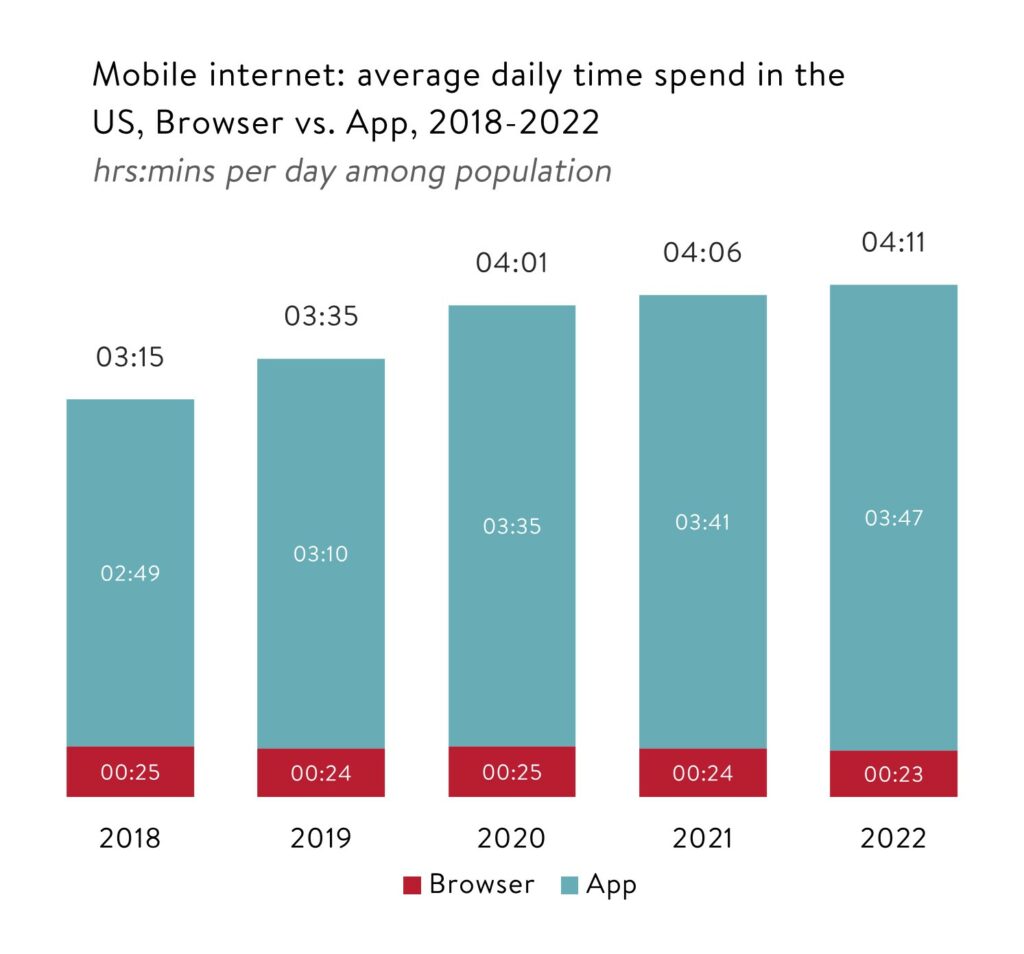

In-app advertising has rapidly grown over recent years, owing to the increasing dominance of smartphone usage across the average consumer’s digital activity. The vast majority of today’s smartphone users spend most of their time in apps rather than web browsers, with the average person spending 3 hours and 41 minutes per day in apps (an increase of 30% just two years prior) compared to 24 minutes on a mobile browser (Source: eMarketer).

Consumers downloaded a record number of 218 billion apps in 2020 (Source: Statista), accelerated by the pandemic which saw people spending more time connected to their smartphones and mobile devices than ever before.

Consequently, higher click-through rates are being achieved on apps compared to those served on the mobile web. According to Medialets, average click-through rates for apps is 0.58% whereas mobile web has a click-through rate of 0.23%. Another study by AppSavvy shows that in-app ads perform 11.4 times better compared to banner ads on mobile websites. Given these figures, it’s no surprise that ad revenues achieved from in-app advertisements are forecasted to triple by 2025 and reach $226 billionas businesses across industries are investing more of their budget in in-app advertising (Source: Grand View Research, Market Analysis Report).

In addition, mobile in-app advertising is about to get a huge boost from advances with 5G. By 2023, the number of 5G customers is expected to hit 1 billion across the globe, compared to 200 million in 2019. (Source: The Drum). Impressive speeds delivered by 5G will result in much better user experiences on mobile, particularly with high-definition media and interactive technologies, such as the mobile gaming and mobile video streaming spaces. 5G will undoubtedly have a significant impact on in-app advertising.

M&A activity accelerates around mobile ad technology

As with the broader AdTech sector, mobile advertising companies have been in hot demand over the past year which is reflected in volume of deals and the increasing valuations. In the 8 month period to 31st August 2021, there have been 29 M&A and fundraisings which is marginally less than 2019 and 2020 and the publicly listed average valuations are sitting at £140m in 2021 compared to £45m in 2020 and £5m in 2019 (Source: Pitchbook).

Notable recent deals in this space include:

- US tech giant Cisco acquired cloud communications software and services provider IMImobile for $730m

- Digital Turbine, a leading mobile growth platform, acquired Fyber, a mobile advertising monetisation platform for $600m

- Skillz, the leading mobile games platform, acquired Aarki, a leading technology-driven marketing platform for $157m

- More recently this month, Zynga, a global leader in interactive entertainment, acquired Chartboost, a mobile programmatic advertising / monetisation platform for $250m, and Tiger Global Management invested $167m in MOLOCO valuing the company at $1.3bn.

Mobile advertising companies have attracted increased levels of investment and acquisition interest over the past two years, a trend that shows no signs of slowing down and one that we believe is firmly here to stay.

What’s coming next?

Following Apple’s release of iOS 14.5 and the removal of IDFA, the in-app advertising is facing a once-in-a-generation shift.

Advertisers will not be able to rely on the same level of targeting data and insights as they have previously which will limit their ability to create campaigns for targeted audiences. The full implications of this shift are yet to fully play out, but the opportunities are great as advertisers adapt to finding efficient targeting methods through a focus on creative, data analysis and audience creation. Leveraging first-party data will also play a critical role in building durable and valuable customer relationships.

Virtual Reality (VR) and Augmented Reality (AR) will also play a big role in the future of mobile advertising, allowing consumers to engage and interact with different products and experiences. These trends have already started to emerge in advertising campaigns, from online catalogues to interactive games and 3D product-viewing experiences. For example, Pokémon Go, one of the most successful augmented reality mobile games of all time, allows users to interact with their surroundings in real time. Last year, Pokémon Go had its most profitable year since launching in 2016, with in-app purchase revenues surpassing $916m worldwide.

More recently, TikTok launched a creative toolset this month called TikTok Effect Studio which will allow its own developer community to build AR effects for TikTok’s short-form, video sharing app. TikTok have also announced plans to offer in-app shopping experiences in a partnership with Shopify to add the ability for consumers to shop directly in the TikTok app for the first time.

Alongside greater use of VR and AR, we will see shift in in-app ad formats towards native advertising. Unlike display ads or banner ads, native ads fit the native look and feel of the media format in which they appear, making them look less like an ad and therefore less intrusive. With banner and display ads increasingly having lesser effect on consumers and more people using ad blockers, native advertising has emerged as a more reliable and effective way to reach consumers. Native advertising will inevitably translate in higher click-through rates.

Stay tuned as we will be releasing an article in the coming weeks exploring the new IDFA landscape and the impact on in-app advertising.

Find out more about what we do here.

Contact hello@wypartners.com if you have any questions or wish to discuss anything further.