The e-commerce landscape is undergoing considerable transformation: the exceptional levels of growth from the pandemic are stalling, whilst the current macro-economic conditions are creating new pressures for online businesses.

It is not surprising that the global pandemic served to accelerate this already fast-growing industry, shifting more sales away from bricks & mortar towards online channels. Two years ago only 18% of retail sales were made online. That number is expected to reach 21% in 2022 which represents 18% growth over two years. This increase is forecast to reach 24.5% by 2025, which translates to a 6.7 percentage point increase in just five years (Source: Shopify).

However, there are signs that the Covid boom and resulting growth may be flattening, particularly in the public markets, which have seen share price corrections for companies such as THG, Asos, Boohoo (all UK), Shopify and even Amazon (both US). E-commerce businesses will inevitably feel margin pressures on account of exposure to the current inflationary conditions, difficulties with a global supply chain, higher digital advertising costs, and of course the increased competition entering the market.

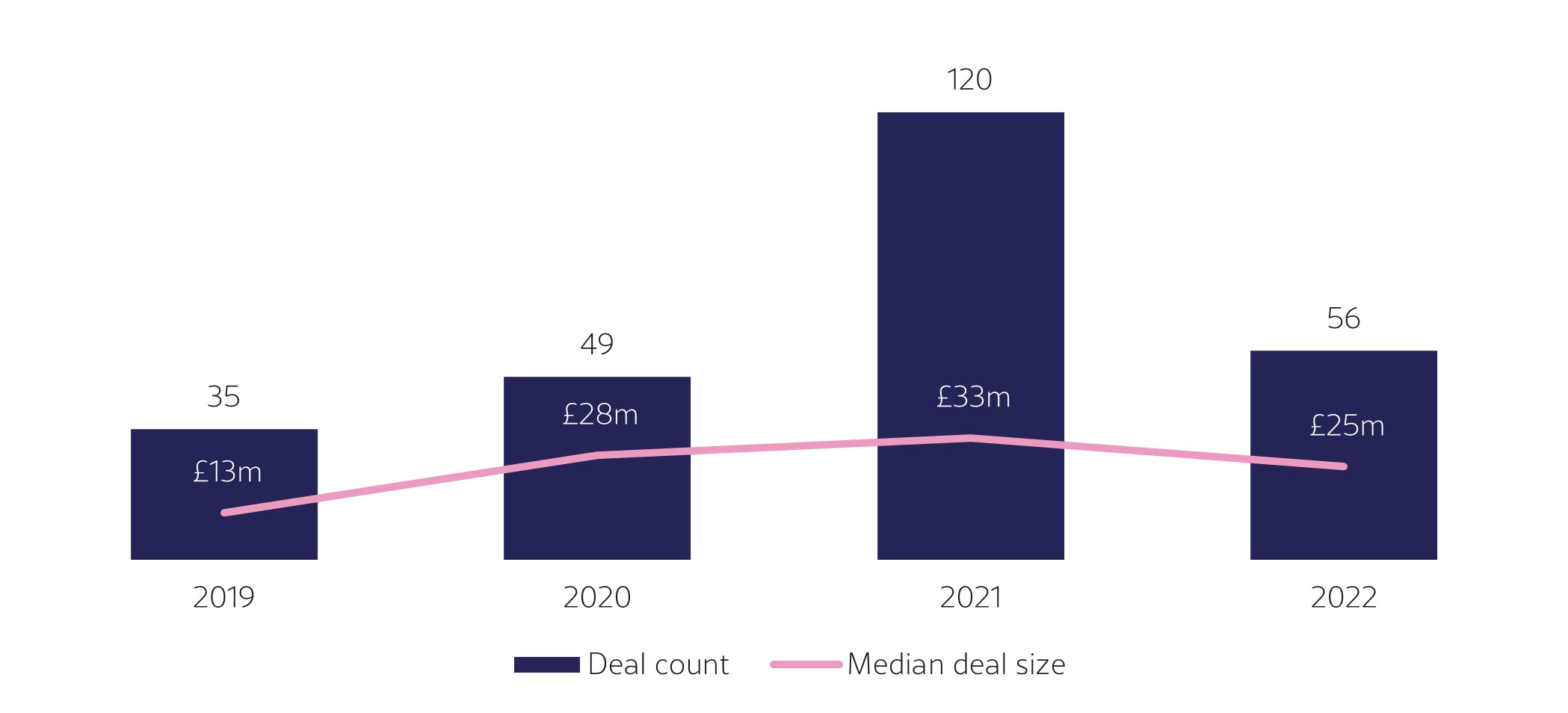

Recent M&A activity

We have tracked buyers and investors in the media and technology world and identified some recent deals that highlight interesting trends in e-commerce M&A.

Two of the global networks have already shown their hand: Publicis acquired an e-commerce analytics tool, Profitero, to enhance their practical commerce offering, and WPP launched Everymile, a managed service providing brands with a fully outsourced direct-to-consumer (DTC) e-commerce solution. This theme of providing an end-to-end solution can also be seen in Shopify’s largest ever acquisition of the e-commerce fulfilment business Deliverr.

The challenger network, Stagwell, acquired Brand New Galaxy, adding a deep, digital-first specialisation to their already broad e-commerce capabilities in order to service more complex global clients. At the smaller end of the scale, UK marketing group Brave Bison acquired Best Response Media, and Bridgepoint-backed IDHL continues to implement their e-commerce focused M&A strategy.

Buyers continue to desire businesses with specialised capabilities in Amazon, Magento (Adobe), Cloud Commerce (Salesforce) and Shopify which can enhance their wider marketing machine to provide brands with a holistic e-commerce offering.

Another interesting development has been the approach to valuation for these high-quality e-commerce assets. Heightened competition has forced buyers to re-think their traditional profit valuation metrics and consider pricing based around revenue multiples in order to win the bidding wars. In processes, buyers will need to weigh up the trade-off between immediate multiple arbitrage and enhancement of capability.

What’s next?

Recent M&A activity leads us to conclude that the marketing world views the current macro-economic conditions as a short to medium-term shock, rather than a lasting structural change to the industry. Buyers and investors continue to show strong appetite for assets with e-commerce capabilities, particularly those that specialise in logistics and fulfilment, which can put an end to reliance on third-parties and enable an end-to-end solution.

WY Partners offers specialist M&A advice to businesses who are seeking to either buy, sell or raise investment at the intersection of media and technology.

See how we analyse the latest global M&A activity across the media and technology sectors using our live M&A tracker here.

Contact Alastair Greenfield at agreenfield@wypartners.com if you have any questions or wish to discuss anything further.