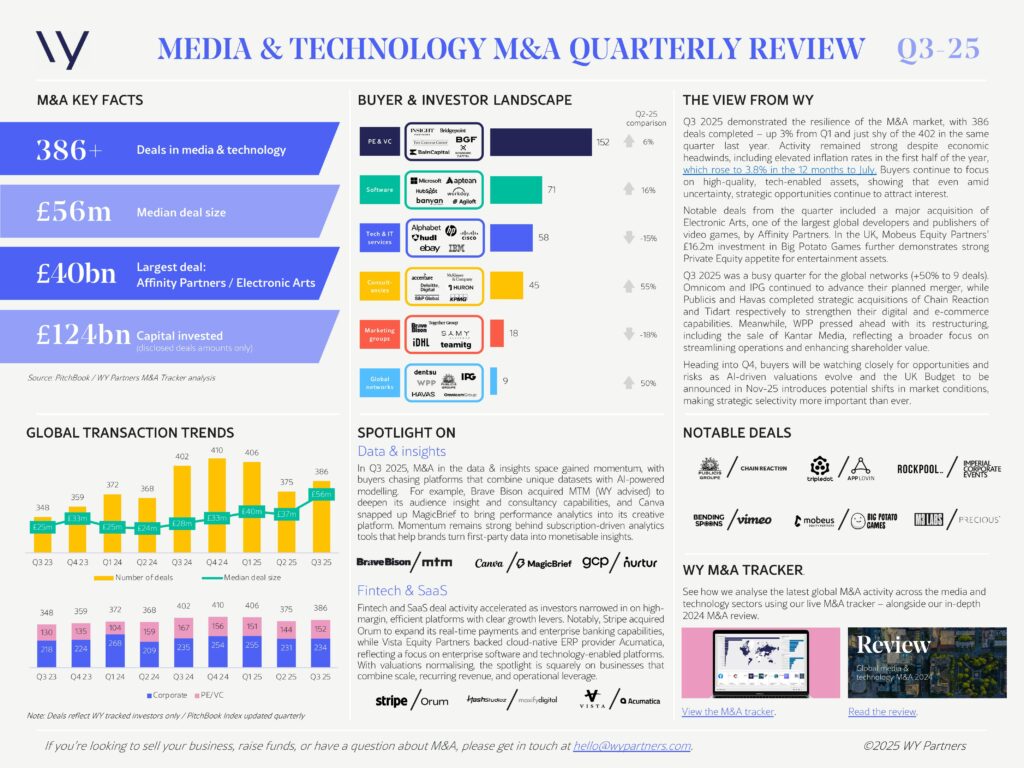

M&A activity in Q3 2025 remained resilient, with 386 deals completed – up slightly from Q1 (375) and just below last year’s levels (402). Despite persistent macroeconomic headwinds, including elevated inflation, buyer appetite for high-quality, tech-enabled assets in media and technology remains strong. While overall buyer activity softened in some segments, global networks saw a notable uptick (+50%), signalling renewed strategic confidence among major acquirers.

Notable deals included Affinity Partners’ £40bn acquisition of Electronic Arts and Mobeus Equity Partners’ investment in Big Potato Games, highlighting continued appetite for entertainment and digital content assets.

Strategic buyers also remained active, with Omnicom and IPG advancing their planned merger, and Publicis and Havas expanding capabilities through targeted acquisitions. As we head into Q4, investors are expected to remain selective as AI-driven valuations evolve and the UK Budget looms in November.

If you have any questions, or would like to chat to about your upcoming M&A plans, please get in touch at hello@wypartners.com.