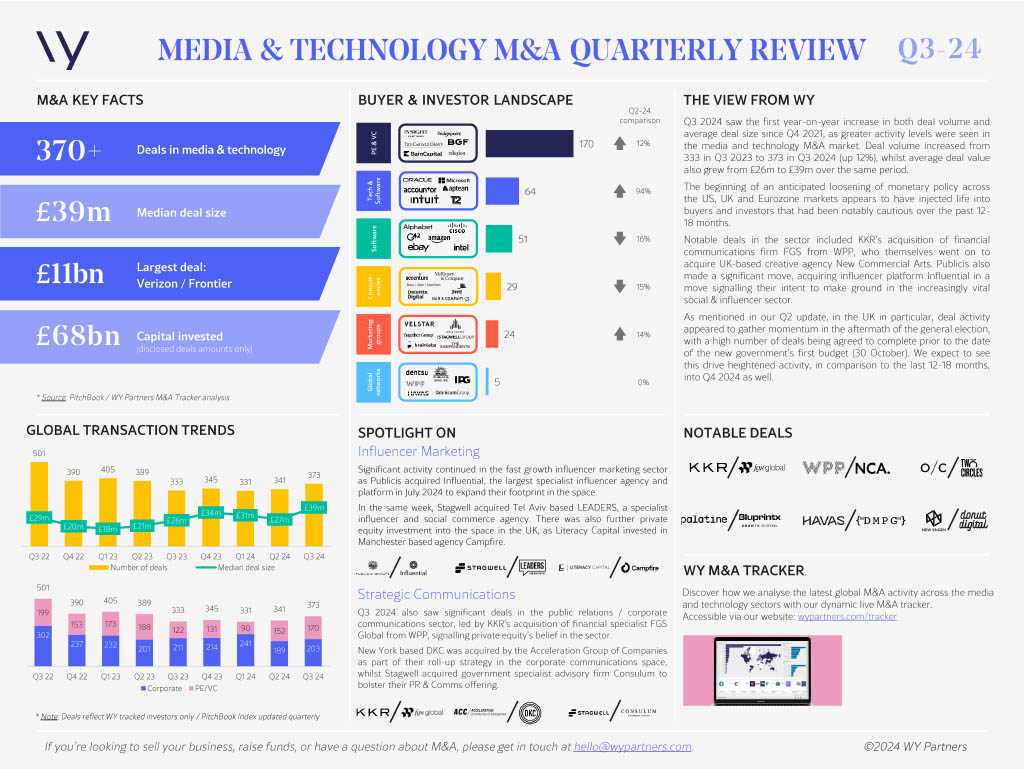

Q3 2024 saw the first year-on-year increase in both deal volume and average deal size since Q4 2021, as greater activity levels were seen in the media and technology M&A market. Deal volume increased from 333 in Q3 2023 to 373 in Q3 2024 (up 12%), whilst average deal value also grew from £26m to £39m over the same period.

The beginning of an anticipated loosening of monetary policy across the US, UK and Eurozone markets appears to have injected life into buyers and investors that had been notably cautious over the past 12-18 months.

Notable deals in the sector included KKR’s acquisition of financial communications firm FGS from WPP, who themselves went on to acquire UK-based creative agency New Commercial Arts. Publicis also made a significant move, acquiring influencer platform Influential in a move signalling their intent to make ground in the increasingly vital social & influencer sector.

As mentioned in our Q2 update, in the UK in particular, deal activity appeared to gather momentum in the aftermath of the general election, with a high number of deals being agreed to complete prior to the date of the new government’s first budget (30 October). We expect to see this drive heightened activity, in comparison to the last 12-18 months, into Q4 2024 as well.

If you have any questions, or would like to chat to about your upcoming M&A plans, please get in touch at hello@wypartners.com.