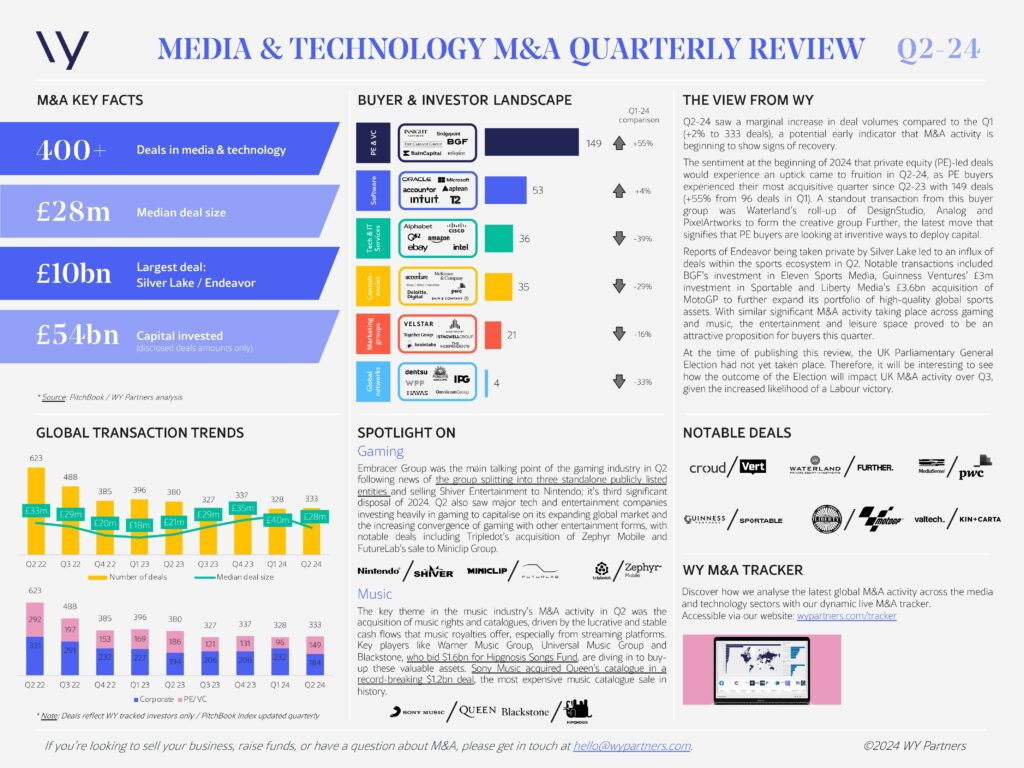

Q2 2024 saw an increase in deal volumes compared to Q1, suggesting early signs of recovery in M&A activity. PE buyers had their most active quarter since Q2 2023, with 149 deals, a 55% increase from Q1 2024. Notable transactions, such as Waterland’s formation of creative group Further, indicate ongoing interest from PE in the marketing space.

Significant deals in the sports sector included Silver Lake’s privatisation of Endeavor, BGF’s investment in Eleven Sports Media, Guinness Ventures’ £3m investment in Sportable, and Liberty Media’s £3.6bn acquisition of MotoGP.

Embracer Group made headlines by splitting into three entities and selling Shiver Entertainment to Nintendo. Major tech and entertainment companies also invested heavily in gaming, with notable deals such as Tripledot’s acquisition of Zephyr Mobile and FuturLab’s sale to Miniclip Group.

M&A activity focused on acquiring music rights and catalogues. Key deals included Warner Music Group, Universal Music Group, and Blackstone’s $1.6bn bid for Hipgnosis Songs Fund, and Sony Music’s acquisition of Queen’s catalogue for a record-breaking $1.2bn.

The impact of the UK Parliamentary General Election results on Q3 M&A activity remains to be seen.

If you have any questions, or would like to chat to about your upcoming M&A plans, please get in touch at hello@wypartners.com.