Introduction

The global animation and visual effects (‘VFX’) market has experienced significant growth in recent years, fuelled by a proliferation of investment in the video streaming and gaming industries. As consumers seek access to engaging digital experiences and immersive content and with the emergence of 4G and 5G infrastructure over the past decade making content more readily accessible, the global animation and VFX market has grown to in excess of $168bn (Source: Marketstatsville).

For VFX and animation specialists, meeting the high levels of demand for technically accomplished content across film, tv and gaming, has increased the requirement for both highly skilled labour and technical equipment. This has led to industry challenges, with studios experiencing capacity constraints driven by a shortage of the highly skilled VFX and animation professionals that are required to deliver increasingly complex projects.

In this article, we explore two key ways in which studios are investing to increase capacity in both the short and long-term, looking at recent trends in M&A and how new technologies are disrupting traditional animation and VFX models.

M&A activity

M&A has offered established industry players the opportunity to rapidly increase headcount and scale, reduce labour costs by entering lower cost markets and capitalise on geographical benefits such as film production tax credits, which vary on a by-country basis.

Cinesite, the London-based group whose recent productions include films from both the James Bond and Star Wars franchises, has best embodied this prioritisation of M&A with four acquisitions in 2022, including its first foray into Asia with the acquisition of Assemblage and two deals in Canada, where regional film production tax credits range between 25 and 40%.

2022 also saw a number of other notable deals including Sony’s acquisition of Mayfair Equity-backed Pixomondo, Picture Head’s acquisition of Ingenuity in the US, Envy’s acquisition of Absolute VFX and BGF backed Milk VFX’s acquisition of VFX studio Lola Post Production.

Streaming providers have looked to M&A to diversify content offerings and bring animation and VFX capabilities in-house. Netflix acquired Sydney-based studio Animal Logic in Jul-22, marking their second investment in the animation and VFX space, following the acquisition of Scanline at the back end of 2021.

Institutional investors have also shown confidence in the VFX and animation market in recent years. Aleph Capital and Crestview Partners co-invested in FC3, whose key brand is Framestore, who subsequently acquired Method and Company 3 in late 2021. Growth equity deals in the UK have also included Key Capital Partners’ investment in Jellyfish Studios and YFM’s investment in Outpost VFX.

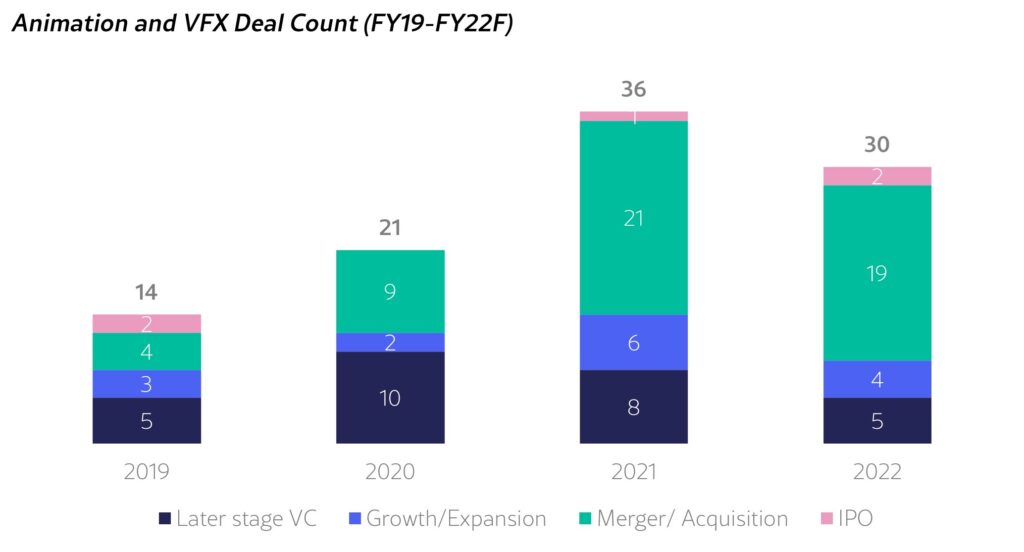

As the increase in deal activity across the VFX and animation landscape illustrated in the graph below shows, M&A has become a key strategic priority for major industry players in recent years.

Source: Pitchbook. Deal volumes have blossomed over the last four years, with key acquirers seeing M&A as crucial to overcoming capacity constraints, acquiring talent and entering new geographies.

Advancements in technology

Whilst M&A is a practical solution for larger buyers to quickly expand operations by entering new geographies and acquiring talent, in the long-run businesses are also investing in new technologies to improve efficiency within the visual effects and animation processes and to reduce costs.

We outline the key technological advancements that are being used in the VFX and animation world:

- Cloud computing: VFX and animators are looking to cloud computing to increase scalability by accessing increased computer power and storage capacity, which in turn allows for faster rendering times. Rendering is traditionally the most computationally demanding aspect of the animation process, especially within animation following an industry shift from 2D to 3D.

- Virtual production: Virtual production saw a significant increase in usage during the pandemic and utilises real-time game engines and 3D environments to create realistic on-screen visuals and brings an element of the visual effects process through to the pre-production stage. Animators have benefitted from refining productions in real time, which reduces the time intensity of the post-production process and thus facilitates cost savings.

- Artificial intelligence (‘AI’): Algorithms and machine learning have been utilised mostly in two key ways in the animation and visual effects world. Firstly, by automating a wide range of workflows including motion capturing, rigging, compositing and rendering to reduce costs and increase efficiency. Secondly, AI has facilitated enhanced realism of both character animation and landscape generation to create more immersive animated content and visual effects.

What’s next?

The use of new technologies is becoming more commonplace in high-end animation and VFX. AI has been widely deployed in high-end animation in recent years including for blockbusters such as Avatar: The Way of Water and The Batman, whilst StageCraft, responsible for the virtual production of The Mandalorian, have been widely praised for their revolutionary VFX technology.

However, the adoption of new technologies can be expensive for studios, especially virtual production, which requires both highly skilled employees and expensive hardware in the form of LED walls, cameras and tracking systems. Whilst we expect new technologies to continue to disrupt the industry going forward, the capital outlay required suggests that the transformative impact will not be overnight.

A continuation of the opportunistic M&A seen over the last few years is therefore likely and will remain high on the agenda of large cash-rich buyers as long as capacity constraints continue in the market. Some key players such as Cinesite and leading vfx company, DNEG, have already announced their intentions to remain acquisitive and have access to acquisition finance facilities, whilst private equity injections into other buyers such as Framestore and Picture Head illustrate that there is capital to be deployed in the market.

Ultimately, the successful adoption of new technologies and strategic M&A deals will be essential in ensuring that animation and VFX studios can meet the evolving demands of audiences and remain competitive in a fast-paced, rapidly changing market.

WY Partners offers specialist M&A and fundraising advice to businesses who are seeking to either buy, sell or raise investment in media and technology.

Please contact Alex Crawford at acrawford@wypartners.com if you have any questions or wish to discuss this article further.