By the end of 2019, 47% of global ad spend is anticipated to relate to the internet – $292 billion. Since the world’s first website was published on 6 August 1991, by British physicist Tim Berners-Lee, the internet has continued to transform all industries, not least media.

Perhaps surprisingly, it was not until 2017 that the internet overtook TV as the main ad spend channel, globally, as we can see from our interactive chart below. One of the reasons for this is clearly the increase in the number of people with internet access, but the emergence of mobile and smartphone technology has been the key driver of the shift in how advertisers choose to spend their media budgets.

China currently accounts for almost 20% of worldwide internet users, at 800 million. Of these users, 98% are via mobile, demonstrating just how mobile technology has become a vital part of everyday life across the country.

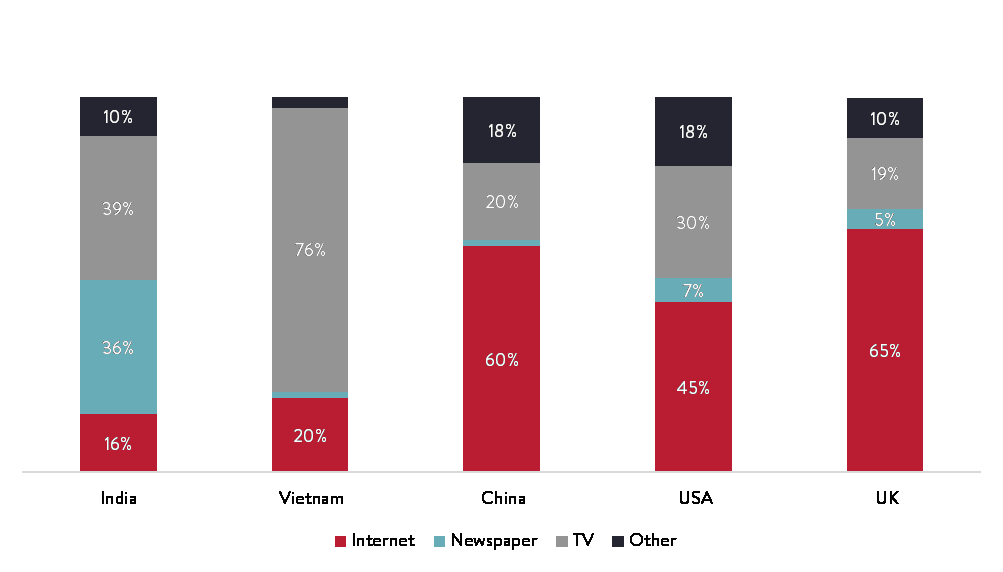

Behind China lies India, with over 500 million internet users out of a total population of 1.4 billion. Interestingly, unlike in China where 60% of overall ad spend in 2018 related to the internet, in India it was a mere 16%, lagging behind not just TV (39%), but also newspaper (36%).

Vietnam, one of the fastest growing economies in the world with a rapidly growing population, half of whom are under 35, also has some catching up to do in terms of ad spend allocation, with the internet contributing a mere 20% of overall spend in 2018.

Ad spend allocation in selected countries (2018)

Source: Market Intelligence

With 3.5 billion people still without access to internet and advertisers in some of the world’s largest economies still electing to spend large proportions of their budgets on traditional media channels, we can expect to see the percentage of global internet related ad spend continuing to increase significantly in the coming years.

Programmatic will continue to play a critical role in this transition, which is why it’s unsurprising that the likes of S4 Capital have invested heavily in the space and we expect significant M&A opportunities to lie here ahead.