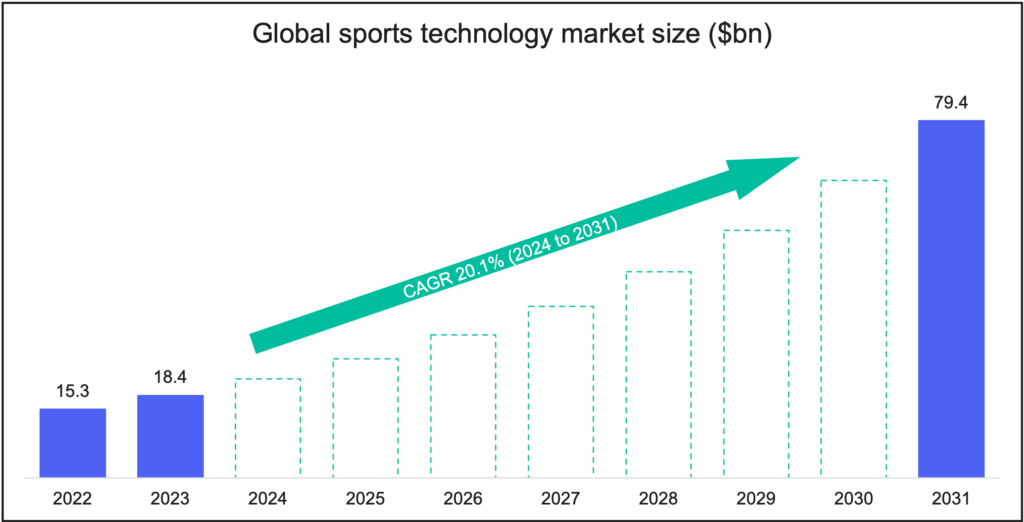

Long before Artificial Intelligence (AI) became a buzzword, the integration of data and analytics into sports was revolutionising the industry. The trajectory shown below illustrates that we stand at a pivotal moment in the growth of the sports technology sector, with forecasts predicting the market to expand to $79bn by 2031 (Source: SkyQuest).

The remarkable success of Billy Beane (American former professional baseball player) and the Oakland A’s in the early 2000s marked the beginning of this transformation, and the data-centric approach he pioneered has since risen in prominence to dominate sport today.

The approach was so revolutionary at the time that it was later adapted into the film Moneyball (from a book of the same title), whereby Billy and his staff pioneered prioritising statistics over a gut-feeling to assemble a winning team.

Over two decades later, Brentford FC used a similar approach to rise to the Premier League on a comparatively low budget, while Brighton & Hove Albion achieved a record £122.8m annual profit in 2023 thanks to a data-led player recruitment model.

Off the pitch, technological advancements and the proliferation of statistics have fuelled consumer interest in the data side of sport, which has helped drive impressive growth in the fan engagement and experience sector in recent years. The rising demand for immersive fan experiences is evidenced by Virtual Reality (VR) specialist Rezzil’s recent four-year partnership with the Premier League. Rezzil, who WY Partners recently visited in Manchester, are the world’s leading cognitive sports trainer who have developed a VR platform to help analyse player development, provide instant feedback, drive reflective learning, aide rehabilitation and much more.

So, the adoption of technology and data in sport is nothing new, but how does AI level the playing field and present an opportunity for a modern-day Billy Beane to further transform the world of sport?

AI and Sports: Levelling the Playing Field

From chatbots to astronomy, the meteoric rise of AI has threatened to disrupt the world at a rate not seen since the invention of the internet. Elite sports hinge on fine margins, and the rush to implement AI to gain an advantage could shape a team or athletes’ success for years to come.

Where Billy Beane would have worked tirelessly to analyse and scrutinise vast swaths of data to identify the right targets, modern managers at all levels of sport can adopt AI to evaluate infinitely more data points in a matter of seconds. AI and analytics software are levelling the playing field, allowing amateur sports teams and everyday enthusiasts to track and analyse their own performance in a way only their favourite athletes previously could.

Case Study: How Prospect is Pioneering AI in Sports

Founded by Gordon Hamilton Fairley and James Tozer in 2019 – Prospect is a prime example of AI’s influence on sports. The business originated in the founders’ own homes, using its AI-driven insights to aide England Rugby’s coaching staff with key in-game decisions. Having helped England to reach the 2019 Rugby World Cup final, the business has expanded its offerings and now merges cutting-edge AI solutions with industry expertise to navigate both the performance and commercial challenges within sports and media.

Like Billy Beane, their goal is simple: to revolutionise decision-making in sports. By leveraging AI and advanced analytics over traditional instinct and intuition, they are empowering their clients to gain a competitive edge through data-driven insights.

As companies like Prospect gain prominence, their potential for attracting M&A interest increases, underlining the synergy between AI development and M&A strategies.

Recent M&A Trends

Despite a sluggish overall M&A market in 2023, sports tech experienced a record-breaking year with over $37bn in M&A and financing rounds (per Drake Star).

While media and broadcasting deals continued to dominate activity in the sector (e.g. Endeavor’s $9.3bn takeover of WWE), another notable segment that has seen increased deal activity since 2023 is wearable and performance enhancing technology (e.g. CSG’s acquisition of sports tech product manufacturer Vista Outdoors for $1.9bn). The segment has undergone significant growth and transformation in recent years, with M&A activity driven by the integration of advanced analytics, the expansion of ecosystems and market consolidation.

Charterhouse Capital Partners’ recent deal to acquire data-driven sports marketing agency, Two Circles, signals private equity interest in the sector. The success that Two Circles has enjoyed since the takeover may encourage further activity from private equity into growing sports tech businesses.

Forecasting M&A Activity: What’s Next?

The momentum in M&A has continued throughout 2024, highlighted by sports-focused investment initiatives from major players like JP Morgan and Goldman Sachs. Focus areas will likely include AI, fan engagement and ticketing, highlighting a demand for innovative solutions that improve operational efficiency enhance the fan experience.

Silver Lake’s $13bn privatisation of Endeavor underscores what is looking to be another robust year for M&A in a sector that continues to divert from broader market trends, though the full impact this landmark deal will have on the market is yet to be realised.

If you have any questions or would like to chat about your upcoming M&A plans, please get in touch at hello@wypartners.com.